Did any distro give concrete reasons for why they have actively chosen not to package it, or perhaps they just haven’t given it much thought yet?

Did any distro give concrete reasons for why they have actively chosen not to package it, or perhaps they just haven’t given it much thought yet?

This is not what I would consider a “political reason”. A political reason would be something like refusing to package it because of what political party Howard supports.

There is plenty of software you’ll find in these repositories that aren’t under the GPL. CMake uses BSD, the Apache web server uses the eponymous Apache license, LibreOffice and Firefox use MPL, Godot and Bitcoin Core use the MIT license, and I’m sure there are plenty of other software licenses that I haven’t thought of yet.

So obviously I ended up in the middle of this bell curve. How would that cause the perception of the ball’s acceleration to differ?

Either that or because they want to feel like a big boy all mighty and powerful by telling the federal government to kick rocks

If the set of all strings of composite length is a regular language, you can use that to prove the set of all strings of prime length are also a regular language.

But it’s also easy to prove that the set of language of strings of prime length is not regular, and thus the language of strings of composite length also can’t be regular.

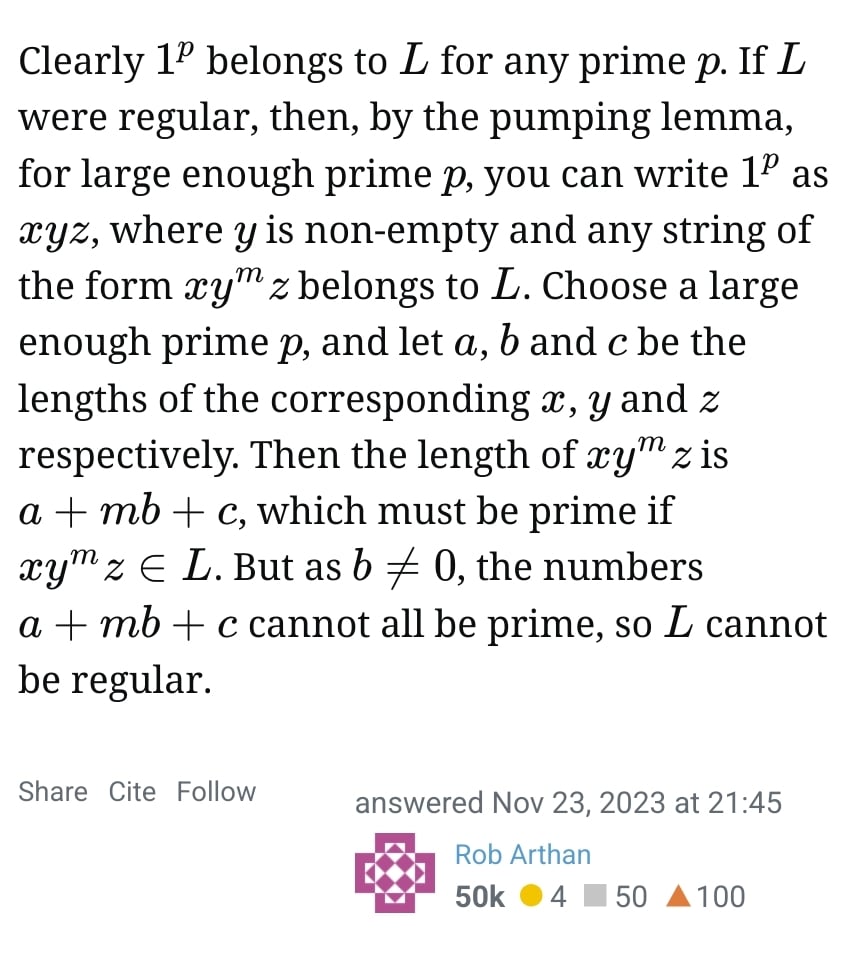

You got downvoted here but you’re absolutely right. It’s easy to prove that the set of strings with prime length is not a regular language using the pumping lemma for regular languages. And in typical StackExchange fashion, someone’s already done it.

Here’s their proof.

Claim 1: The language consisting of the character 1 repeated a prime number of times is not regular.

A further argument to justify your claim—

Claim 2: If the language described in Claim 1 is not regular, then the language consisting of the character 1 repeated a composite number of times is not regular.

Proof: Suppose the language described in Claim 2 is regular if the language described in Claim 1 is not. Then there must exist a finite-state automaton A that recognises it. If we create a new finite-state automaton B which (1) checks whether the string has length 1 and rejects it, and (2) then passes the string to automaton A and rejects when automaton A accepts and accepts when automaton A rejects, then we can see that automaton B accepts the set of all strings of non-composite length that are not of length 1, i.e. the set of all strings of prime length. But since the language consisting of all strings of prime length is non-regular, there cannot exist such an automaton. Therefore, the assumption that the language described in Claim 2 being regular is false.

Average Matt Parker code

“at least 2 characters repeated [at least] twice” implies the string’s length is divisible by a number greater than 1.

Yeah but it’s just so tempting… It validates so many inputs so easily…

They said—

A line with exactly 0 or 1 characters, or a line with a sequence of 1 or 3 or more characters, repeated at least twice

Note—

…or a line with a sequence of 1 or 3 or more characters, repeated at least twice

It should be—

…or a line with a sequence of 2 or more characters, repeated at least twice

The regex in the post will match “abab”. Their original description (line 2 of this comment) will not match “abab”.

Economic murder-suicide pact

It’s a line with a sequence of two or more characters repeated at least twice.

Yeah, and what the fuck else might I be referring to, hmmmm?

Yes, they’re similar, but from what I’ve heard, most UK building societies are basically the same as or worse than banks in terms of fees, rates, and service quality. In the US, most credit unions will absolutely spank the big banks on at least two of those, if not all three.

Oops, I didn’t see that. My bad. Guess I made a fool of myself here.

Well, you see, that depends on whether you have a team of highly-paid defence lawyers that can get you off if the prosecution makes even the slightest mistake in their case.

Okay, have a good day. I voted for Harris.

You’re free to disagree with the way the American legal system is structured. I’m not here to argue with you, and in many ways, I actually agree with you wholeheartedly that Garland would make a terrible judge in my notion of an ideal legal system.

The role of a judge in an inquisitorial system is to answer the questions “Did they do it? Do they deserve to be punished?”

In the traditional English system, this is the role of the jury. The judge is just there to ensure everyone is playing by the rules of the court. And in that role, Garland is pretty suitable. And yes, a sense of fairness and impartiality is not strictly required. Just a sense of logic, which Garland definitely has. You can correctly describe that as a fault of the legal system.

I apologise if you find this insulting.

Think of the judge in My Cousin Vinny. Do you think that he walked into that courtroom every day thinking “these idiots definitely did it”? It’s very likely he did. But he also recognised it wasn’t his job to broadcast that to the court. He had to put on a mask of neutrality because he recognised that it is the jury’s role to determine guilt, not his. He doesn’t need to be truly impartial to the defence’s case; he just needs to make the correct evidentiary and legal rulings. Which he mostly did.

Contrast that to the role of the prosecutor, which is what the attorney-general is. It’s the prosecutor’s job to come into court thinking “these guys are guilty” and convince the jury of the same.

nooooo don’t take away my socialism